Stagflation Scenario Slammed As Fed's Favorite Inflation Indicator Tumbles To Four Year Lows

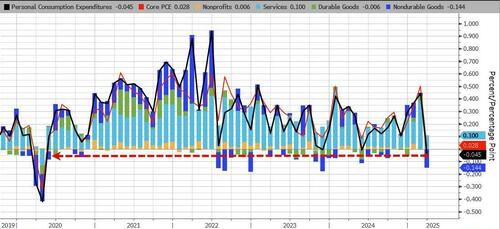

The Fed's favorite inflation indicator - Core PCE - printed cooler than expected in March, unchanged MoM (vs +0.1% exp), bring prices up 2.6% YoY - the lowest since March 2021...

Source: Bloomberg

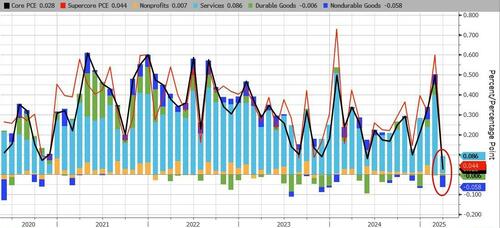

...with non-durable goods deflating MoM the biggest drag on Core PCE

...but, but, but we were told tariffs would spark hyper-super-scary-inflation?

The headline PCE was -0.045% MoM - the biggest MoM drop since COVID lockdowns...

...dragging headline PCE YoY down to +2.3%...

SuperCore PCE also saw the YoY pace slow significantly...

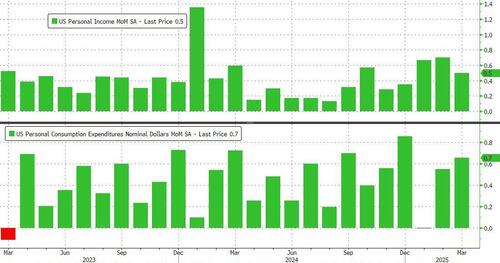

Spending outpaced incomes significantly in March...

Source: Bloomberg

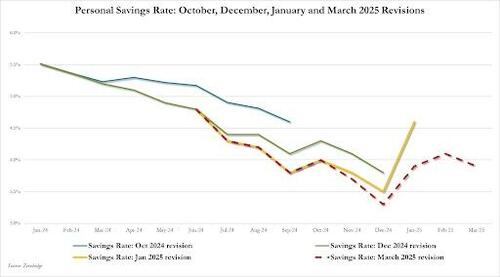

Which means that the savings rate fell to 3.9% from 4.1% in February, which was revised lower from 4.6%...

Adjusted for inflation, real personal spending surged 0.7% MoM (not a total surprise given that 'consumers' are panicking over an imminent surge in inflation, of course they should be spending)....

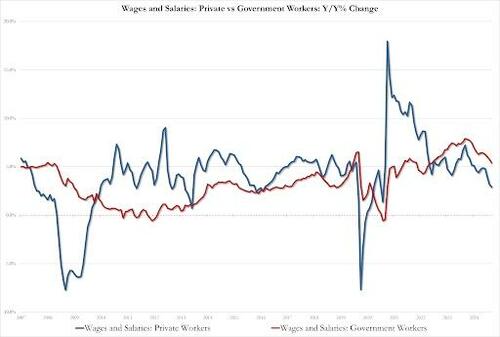

It appears DOGE is doing its jobs too - crushing govt wage growth

March Government worker wages and salaries up just 2.9%, down from 3.2% in Feb and the lowest since Sept 2020

March Private worker wages and salaries up 5.4%, down from 5.7%, and lowest since Dec 2022

...and there goes the stagflation scenario.