Stocks & USTs trade tentatively ahead of a busy data slate and earnings from MSFT & META - Newsquawk US Market Open

- US President Trump said he is going to make a fair deal with China on trade; predicts that China will eat the tariffs.

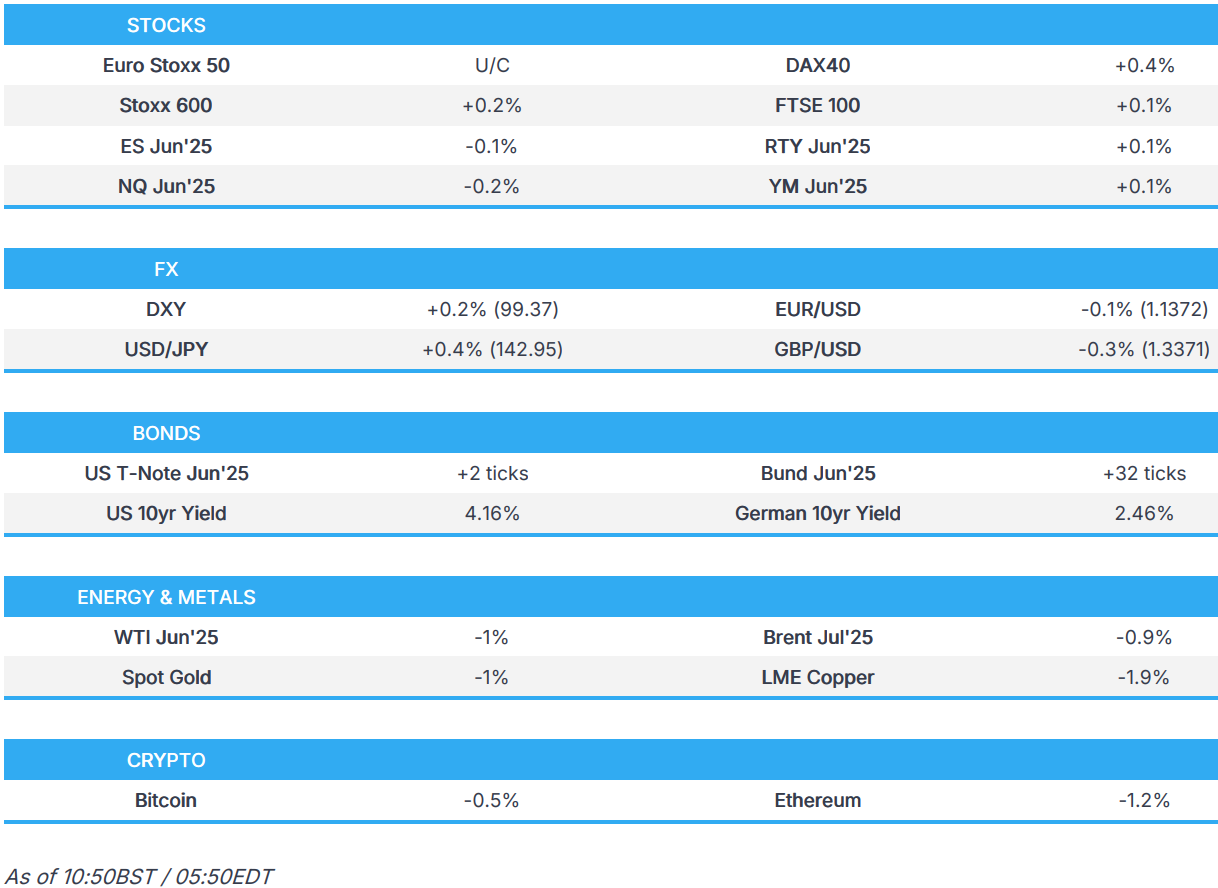

- Stocks trade tentatively ahead of a slew of key risk events, including US GDP/PCE and earnings from Microsoft & Meta.

- USD looks to build on Tuesday’s advances, EUR overlooks strong GDP, AUD is supported by hot CPI.

- USTs are contained into data & refunding, EGBs firmer but largely unaffected by a data deluge.

- Subdued trade across industrial commodities amid uncertainty and overall downbeat Chinese PMIs.

- Looking ahead, US ADP, GDP, PCE (Q1 & for March), ECI, BoC Minutes, Comments from BoE’s Lombardelli, US Quarterly Refunding.

- Earnings from, Microsoft, Meta, Robinhood, Qualcomm, Albemarle, eBay, Humana, Caterpillar, International Paper, GE Healthcare, Hess.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

TARIFFS/TRADE

- Politico writes that trade documents submitted by some countries are "far from final offers", according to a dozen foreign diplomats and three officials Some trading partners are "balking" at proposing even an outline of their terms before they get more guidance from the US. The administration appears to have drawn one red line: it will not lower the 10% universal tariff imposed on April 5th.

- US President Trump signed a Proclamation on "AMENDMENTS TO ADJUSTING IMPORTS OF AUTOMOBILES AND AUTOMOBILE PARTS INTO THE UNITED STATES" and an Executive Order on "ADDRESSING CERTAIN TARIFFS ON IMPORTED ARTICLES".

- US President Trump says they are coming from all over the world, including China, looking to make a deal and he confirmed to ease the impact of auto tariffs, while Trump added they are going to make a fair deal with China on trade, as well as commented that China deserves the tariffs and predicts that China will eat the tariffs.

- US President Trump congratulated Canadian PM Carney on the election win and said the leaders agreed to meet in person in the near future, while Carney said they agreed on the importance of Canada and the US working together, as independent, sovereign nations, for their mutual benefit.

- White House Economic Adviser Miran said we will hopefully start hearing about deals that are done in the coming days to weeks and expects they will move towards a form of de-escalation which will come sometime in the near future, while he added other countries will bear the burden "in the fullness of time.

- South Korean industry officials are to visit Washington on Wednesday for tariff discussions with US counterparts, while South Korean Finance Minister Choi said they not rushing to negotiate on tariffs with the US and they are "absolutely not" trying to conclude tariff talks with the US before the presidential election.

- US officials have split trade negotiations into three phases, the UK has reportedly been placed in either phase two or three, via the Guardian citing sources. UK officials are also concerned that any EU-UK deal could make negotiations with the US more challenging.

- French Finance Minister Lombard says he discussed idea of reciprocal zero tariffs with US Treasury Secretary Bessent, Bessent told him that "this was not unrealistic".

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.2%) opened mostly firmer and have traded tentatively within a tight range ahead of the day’s key risk events.

- European sectors hold a strong positive bias; Media (lifted by post-earning strength in UMG) and Telecoms takes the top spots, whilst Travel & Leisure and Basic Resources underperform.

- US equity futures are trading tentatively on either side of the unchanged mark ahead of a very busy day, packed with key US data points, including US GDP, PCE, Employment Costs and ADP National Employment.

- Earnings include: Mercedes Benz (-0.8%) down Y/Y, high uncertainty noted; Volkswagen (U/C) miss, expects results at lower-end of guidance; UBS (+0.2%) beat; Stellantis (+1.5%) in-line, suspends guidance; Barclays (-0.3%) beat, upgrades NII guidance; GSK (+4%) beat; TotalEnergies (-3.2%) mixed, continue buybacks, confident in growth objective; ASM International (U/C) orders & margin beat; Air France (+1.6%) beat, confirms outlook; Iberdrola (-1.3%) mixed, expect strong performance ahead.

- Microsoft (MSFT) President says the company is to increase data centre capacity by 40% over the next two years in Europe; expanding datacentre operations in 16 European countries.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is currently building on Tuesday's gains in quiet trade. The two main drivers for price action were relief on the tariff front (autos) and soft US data (JOLTS and Consumer Confidence). Data will likely provide some impetus for the Greenback today with Q1 GDP/PCE and monthly PCE due on the docket. Q1 GDP may be seen as stale in some quarters given its precedes the announcement of US tariffs. DXY has ventured as high as 99.43 with Monday's peak at 99.83.

- EUR softer vs. the USD in what has been a busy morning of data which kicked off with steady French GDP, hot French inflation and in-line German GDP which saw the nation avoid a technical recession, but ultimately showed a Y/Y contraction. Thereafter, Eurozone GDP exceeded expectations (Q/Q 0.4% vs. Exp. 0.2%) but failed to have any sway on the EUR given that it doesn't capture the impact of Trump's tariffs (aside from some potential front-loading of orders).

- USD/JPY is higher after Japanese Industrial Production and Retail Sales disappointed overnight, prompting concerns over a negative outturn for Q1 GDP. Attention now turns to the BoJ, where the Bank is expected to keep rates steady. USD/JPY is north of Tuesday's high at 142.75 but is yet to approach the 143 mark.

- GBP is slightly softer vs. the USD and EUR with fresh macro drivers on the light side. Tier 2 data via the Lloyds Business Barometer and Nationwide House Index had little sway on GBP. On the trade front, the Guardian reports that US officials have split trade negotiations into three phases; the UK has reportedly been placed in either phase two or three. UK officials are also concerned that any EU-UK deal could make negotiations with the US more challenging.

- AUD is the marginal outperformer across the majors on account of firm inflation metrics overnight (Q/Q 0.9% vs. exp. 0.8%, Y/Y 2.4% vs. exp. 2.3%).

- PBoC set USD/CNY mid-point at 7.2014 vs exp. 7.2670 (Prev. 7.2029).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A relatively contained start to the session with USTs holding onto Tuesday’s spoils, firmer by a handful of ticks in a 112-03 to 112-09 band. Limited resistance in the near-term, nothing of particular note until 114-03+ from early April and thereafter 114-10. On the data front, the docket begins with ADP as a preview into Friday’s NFP. Thereafter, Q1 GDP, PCE and Employment Costs due. Afterwards, we get the monthly PCE figure.

- Bunds began the morning holding at the top-end of Tuesday’s 131.16-46 parameters, in-fitting with USTs. Then, after the European cash equity open, EGBs began to gradually pick up and despite being knocked briefly by marginally hotter German state CPI metrics than mainland consensus implies, Bunds are at a fresh 131.74 peak. EZ GDP metrics came in above expectations, but ultimately had little impact on the complex given the survey period does not include the implementation of Trump tariffs. German 2041 & 2044 outings were mixed, but ultimately had little impact on the complex.

- Gilts are outperforming, gapped higher by just over 10 ticks and then in-fitting with EGBs after the cash equity open began to extend higher and hit a 93.68 high for the session. Strength occurs despite a lack of fresh drivers in today’s session thus far aside from supply, an auction that came in strong with another b/c well clear of the 3x mark and a slim tail. Results sparked a modest bid in Gilts but one that occurred within existing 93.35-68 confines.

- UK sells GBP 4.5bln 4.375% 2028 Gilt: b/c 3.48x (prev. 3.27x), average yield 3.834% (prev. 4.263%) & tail 0.2bps (prev. 0.4bps).

- Germany sells EUR 1.143bln vs exp. EUR 1.5bln 2.60% 2041 and EUR 0.452bln vs exp. EUR 0.5bln 2.50% 2044 Bunds.

- Click for a detailed summary

COMMODITIES

- Crude is softer for the third session in a row following yesterday's slide which now sees WTI back under USD 60/bbl. Desks pin the downside to ongoing tariff risks alongside expectations of OPEC+ further opening the taps. Furthermore, the bearish Private Inventory report on Tuesday only adds to the downbeat mood. Brent July in a USD 62.17-63.34/bbl range.

- Precious metals are lower across the board amid a firmer dollar intraday and following US President Trump softening the Auto tariffs, which further unwinds some risk premium. Spot gold resides in a USD 3,280.28-3,328.16/oz range at the time of writing, within Monday's USD 3,268-3,353.20/oz range.

- Hefty losses across base metals against the backdrop of a firmer dollar coupled with a cautious risk tone. 3M LME copper is currently in a USD 9,206.17-9,436.60/t range at the time of writing.

- Equinor (EQNR NO) CEO says European gas storage is low, expect a tight market during refilling. Europe will need 200-300 extra LNG cargoes to refill storage this year.

- US Private inventory data (bbls): Crude +3.8mln (exp. +0.5mln), Distillate -2.5mln (exp. -1.7mln), Gasoline -3.1mln (exp. -1.2mln), Cushing +0.7mln.

- Chile's Codelco Chairman said April Copper production +22% Y/Y.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU GDP Flash Prelim QQ (Q1) 0.4% vs. Exp. 0.2% (Prev. 0.2%); GDP Flash Prelim YY (Q1) 1.2% vs. Exp. 1.1% (Prev. 1.2%)

- German State CPIs: State CPIs came in on the hotter side M/M and also haven’t moderated quite as much as expected/implied Y/Y.

- German GDP Flash QQ SA (Q1) 0.2% vs. Exp. 0.2% (Prev. -0.2%); Flash YY SA (Q1) -0.20%% vs. Exp. -0.20% (Prev. -0.20%)

- German Retail Sales YY Real (Mar) 2.2% vs. Exp. 2.4% (Prev. 4.9%); MM (Mar) -0.2% vs. Exp. -0.4% (Prev. 0.8%)

- German Import Prices YY (Mar) 2.1% vs. Exp. 2.6% (Prev. 3.6%); MM -1.0% vs. Exp. -0.8% (Prev. 0.3%)

- German Unemployment Change SA (Apr) 4.0k vs. Exp. 15.0k (Prev. 26.0k); Unemployment Rate SA (Apr) 6.3% vs. Exp. 6.3% (Prev. 6.3%); Unemployment Total SA (Apr) 2.922M (Prev. 2.922M); Unemployment Total NSA (Apr) 2.932M (Prev. 2.967M)

- French CPI Prelim MM NSA (Apr) 0.5% vs. Exp. 0.40% (Prev. 0.20%); YY NSA 0.8% vs. Exp. 0.60% (Prev. 0.80%)

- French CPI (EU Norm) Prelim MM (Apr) 0.6% vs. Exp. 0.40% (Prev. 0.20%); YY 0.8% vs. Exp. 0.7% (Prev. 0.9%)

- Italian Consumer Price Prelim YY (Apr) 2.0% vs. Exp. 2.0% (Prev. 1.9%); Core 2.1% (prev. 1.7%)

- Swiss KOF Indicator (Apr) 97.1 vs. Exp. 101.5 (Prev. 103.9, Rev. 103.2)

- Italian GDP Prelim YY (Q1) 0.6% vs. Exp. 0.4% (Prev. 0.6%); GDP Prelim QQ (Q1) 0.3% vs. Exp. 0.2% (Prev. 0.1%)

- UK Lloyds Business Barometer (Apr) 39 (Prev. 49)

- UK Nationwide House Price MM (Apr) -0.6% vs Exp. 0.0% (prev. 0.0%); YY (Apr) 3.4% vs. Exp. 4.1% (Prev. 3.9%)

NOTABLE EUROPEAN HEADLINES

- Germany's SPD has approved the coalition deal with the CDU/CSU, via Reuters citing sources. SPD's Klingbeil will be the Vice Chancellor and Finance Minister of the new German Government, according to German media.

NOTABLE US HEADLINES

- US President Trump said he achieved the 100 most successful days for a president in US history, while he noted a lot of auto jobs and companies are coming in and we're restoring the rule of law and ending the inflation nightmare, as well as stated the person at the Fed is not doing a good job.

- US President Trump is to hold a cabinet meeting on Wednesday at 11:00EDT/16:00BST.

- Top Trump advisor reportedly struggled to soothe investors in talks after market tumult in which Stephen Miran met with hedge funds and big asset managers after tariffs sparked Wall Street turmoil, according to FT.

- EU set to admit that untangling from the dominance of US tech companies is “unrealistic”, via Politico "A draft strategy seen by POLITICO ahead of its release this spring signals the EU has few fresh ideas to restore Europe as a serious player in global tech — even as responding to the new transatlantic reality becomes a top priority in Brussels."

GEOPOLITICS

MIDDLE EAST

- "Israeli government statement: On Netanyahu's instructions, the army carried out a strike against a group that tried to attack the Druze in Sahnaya (Syria)", via Sky News Arabia.

- Iranian Foreign Minister Araqchi says US sanctions send a negative message during the nuclear talks; E3 will hold talks in Rome on Friday and with the US on Saturday.

- UK forces participated in a joint operation with US forces against a Houthi military target in Yemen, while the UK said the strike was conducted after dark when the likelihood of any civilians being in the area was reduced and all aircraft returned safely.

RUSSIA-UKRAINE

- Kremlin spokesperson says settlement should be reached with Ukraine, and not the US, via Tass "We are working very intensively with the US on Ukraine".

- US President Trump said he thinks Russian President Putin wants peace but he was not happy when he saw Putin shooting missiles, according to ABC News.

- White House Press Secretary said President Trump is confident the Ukraine minerals deal will be signed.

OTHER NEWS

- Pakistan's Information Minister said they have credible evidence that India is planning "military aggression" against Pakistan within 24-36 hours.

- North Korea conducted the first test firing of a new warship, according to Yonhap. It was also reported that South Korean intelligence assessed that North Korea's combat capabilities have improved and that North Korea suffered 600 deaths during its dispatch of troops to Russia, while South Korean intelligence is monitoring a possible surprise summit between North Korea and the US.

CRYPTO

- Bitcoin is a little lower today and trading just shy of USD 95k; Ethereum now sits just shy of USD 1.8k.

- The SEC has dropped its investigation into PayPal’s (PYPL) stablecoin (PYUSD), according to Cointelegraph.

APAC TRADE

- APAC stocks failed to sustain the positive handover from Wall St and traded mixed at month-end as the region digested a slew of data including disappointing Chinese official PMIs, while there was a muted reaction and very few surprises from US President Trump's speech to commemorate his first 100 days back in office.

- ASX 200 eked mild gains as strength in tech, healthcare and financials offset the losses in the utilities and commodity-related sectors but with the upside limited after firmer-than-expected CPI data saw money markets fully price out the chances of a larger 50bps RBA rate cut in May.

- Nikkei 225 was choppy with the upside contained following disappointing Industrial Production and Retail Sales, while the BoJ also kick-started its two-day policy meeting and there were some comments from a group representing major foreign automakers which noted that President Trump's latest tariff order for autos provides some relief but more must be done.

- Hang Seng and Shanghai Comp were indecisive after official Chinese Manufacturing and Non-Manufacturing PMIs disappointed although Caixin Manufacturing PMI topped forecasts, while the mainland heads into a five-day weekend owing to Labor Day holiday closures and participants also reflected on key earnings releases including disappointing results from China's Big 4 banks.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi says China is to adjust economic plans based on global change; to promote transformation of traditional industries; says they are to stabilize markets and expectations Urges to address weak links in economy. Urges to achieve goals in all aspects. Says to understand impact of changes in international situation. Says China to optimize economic planning based on situations. Urges measures to stabilize employment. Says to promote transformation of traditional industries. Says China to adjust economic plan based on global change. Says China needs to adapt to changing situations.

- China NPC standing committee passed the private sector promotion law which will take effect from May 20th.

- Australian Treasurer Chalmers said the market expects more interest rate cuts after inflation figures and he doesn't see anything in the data as substantially altering market expectations.

DATA RECAP

- Chinese NBS Manufacturing PMI (Apr) 49.0 vs. Exp. 49.8 (Prev. 50.5); Non-Manufacturing PMI (Apr) 50.4 vs. Exp. 50.6 (Prev. 50.8)

- Chinese Composite PMI (Apr) 50.2 (Prev. 51.4); Caixin Manufacturing PMI Final (Apr) 50.4 vs. Exp. 49.8 (Prev. 51.2)

- Japanese Industrial Production MM SA (Mar P) -1.1% vs. Exp. -0.4% (Prev. 2.3%)

- Japanese Retail Sales YY (Mar) 3.1% vs. Exp. 3.5% (Prev. 1.4%, Rev. 1.3%)

- Australian CPI QQ (Q1) 0.9% vs. Exp. 0.8% (Prev. 0.2%); YY (Q1) 2.4% vs. Exp. 2.3% (Prev. 2.4%)

- Australian RBA Trimmed Mean CPI QQ (Q1) 0.7% vs. Exp. 0.6% (Prev. 0.5%); YY (Q1) 2.9% vs. Exp. 2.8% (Prev. 3.2%)

- Australian Weighted CPI YY (Mar) 2.40% vs. Exp. 2.20% (Prev. 2.40%)

- Australian CPI Annual Trimmed Mean YY (Mar) 2.70% (Prev. 2.70%)

- New Zealand ANZ Business Outlook (Apr) 49.3% (Prev. 57.5%); Own Activity (Apr) 47.7% (Prev. 48.6%)