"Nothing To Do With Tariffs" - Trump Blames Biden "Overhang" As Stocks Puke After Q1 GDP

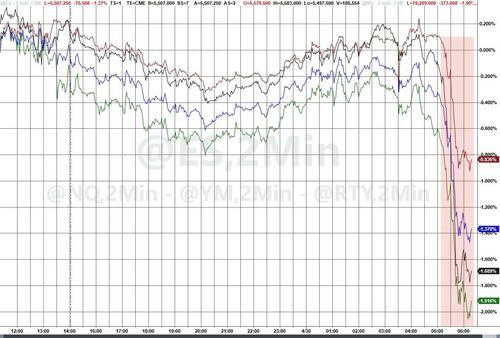

US equity futures are tumbling in the pre-market following a weak ADP employment report and Q1 GDP contraction (driven by a tariff-front-running surge in imports).

In the last month or two, we have been told that President Trump is not focused on the stock market, rejecting the idea of a 'Trump Put' (especially when it came to the decision to 'pause' reciprocal tariffs this month).

However this morning, following the bad data and ugly equity drop, Trump posted on TruthSocial that "This is Biden’s Stock Market, not Trump’s."

I didn’t take over until January 20th.

Tariffs will soon start kicking in, and companies are starting to move into the USA in record numbers.

Our Country will boom, but we have to get rid of the Biden “Overhang.”

This will take a while, has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other.

BE PATIENT!!!

The surge in imports - which dragged down GDP - is due to the tariff decisions, there is no question.

But also bear in mind that this is not a 'classic recessionary slowdown' in the economy, it is a front-running surge in imports 'ahead' of the tariffs and shrinking government spending.

The former is a temporary impact, the latter is what America voted for!!

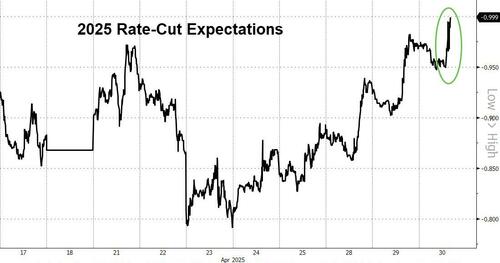

Interestingly, rate-cut odds are rising notably after the data...

Which makes us wonder if 'the market' is now switching to search for the 'Fed Put', not the 'Trump Put'.