BoJ provided some dovish rhetoric, US-China trade updates, Mag 7 numbers ahead - Newsquawk Europe Market Open

- APAC stocks traded higher but with gains capped in severely thinned conditions owing to mass holiday closures across the region and in Europe for Labour Day.

- BoJ kept rates unchanged at 0.50% and provided some dovish rhetoric despite maintaining its rate hike signal.

- US is said to have reached out to China recently for tariff talks, according to Bloomberg citing an influential social media account.

- US stocks were boosted heading into the Wall St closing bell. Futures saw a further lift following strong earnings from Microsoft and Meta.

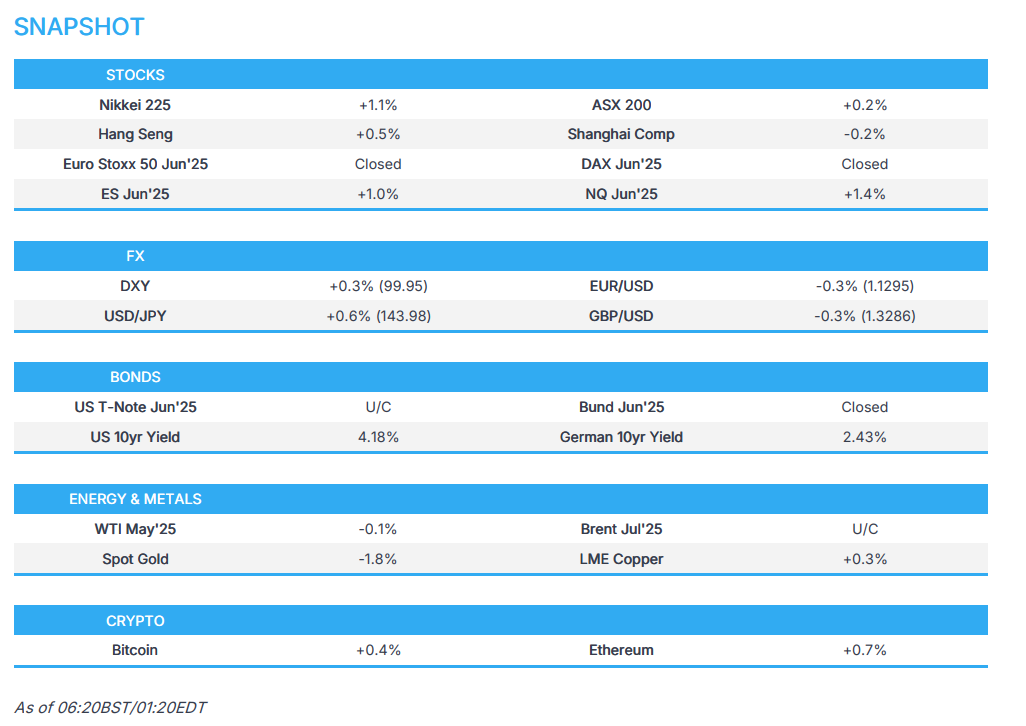

- DXY is higher, JPY lags post-BoJ with USD/JPY eyeing 144 to the upside, EUR/USD sits around the 1.13 mark.

- Looking ahead, highlights include US Challenger Layoffs, Jobless Claims & ISM Manufacturing, BoJ Governor Ueda's Press Conference.

- Earnings from Amazon, Apple, Riot Platforms, Reddit, Airbnb, Eli Lilly, Roblox, CVS, MasterCard, McDonald's, Drax, Hiscox, Lloyds, Kerry, Whitbread, Standard Chartered & Telecom Italia.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy with early selling pressure seen following soft US data including a contraction in the advanced reading for Q1 GDP which was accompanied by rising Core PCE Prices to boost stagflationary concerns. Furthermore, the ADP employment report was soft ahead of Friday's NFP and the Chicago PMI disappointed ahead of the ISM Manufacturing PMI on Thursday, while the March PCE was mixed overall but with upward revisions. As such, equity futures and T-notes tumbled in response to the data but recovered those losses by settlement, while the buying in stocks accelerated into the US cash close on month-end flows.

- SPX +0.15% at 5,569, NDX +0.13% at 19,571, DJI +0.35% at 40,669, RUT -0.63% at 1,964.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said tariffs have not kicked in yet and he knows China is doing very poorly right now, while he added that at a certain point, he hopes for a deal with China. Trump also said that fairness with China includes intellectual property and he does not want China's products unless they are fair.

- US President Trump said China's ships are loaded up, much of which the US does not need and that China is having tremendous difficulty, while he added that China is the leading candidate for ‘Chief Ripper Off-er’. Furthermore, Trump said he thinks they are doing great on trade deals and separately commented that it will happen when asked if he will speak with China President Xi, while he also stated that Canadian PM Carney called him yesterday and said let's make a deal.

- US President Trump reiterated there is a very good chance that they will make a deal with China and any deal has to be on their terms, while he added that they are negotiating with India, South Korea and Japan.

- US President Trump said after a certain amount of time, there will be a tariff wall for pharmaceutical companies.

- USTR Greer said it is a matter of weeks not months to have initial trade deals announced and he is meeting with Japan, Guyana and Saudi Arabia on Thursday and with the Philippines on Friday. Greer added he wouldn't say they are 'finish-line' close on an India trade deal but noted he has a standing call with India's Trade Minister and said they are working closely with the UK and moving quickly with countries ready to move forward on trade. Furthermore, Greer said Canadian PM Carney is a serious person and that President Trump wants a healthy relationship in North America, while he added there are no official talks with China yet and that harmful foreign trade practices, including those in China, need to be addressed.

- US is said to have reached out to China recently for tariff talks, according to Bloomberg citing influential social media account and CCTV affiliate Yuyuan Tantian.

- China is to hold off on entering serious trade discussions with the US while it waits to see which of US President Trump’s advisers will have his ear and how other countries will respond to the 90-day pause on tariffs, according to a source cited by SCMP

- EU is to present trade proposals to the US next week, according to Bloomberg citing officials.

- US Commerce Secretary Lutnick said sovereign wealth funds want to invest in the US and that pharma and automakers are coming to the US, while he added that pharma knows they have to come home. Furthermore, Lutnick said tariff revenue is coming in for the external revenue service and he touted removing de-minimis to help small businesses.

- US Senate narrowly rejected a bipartisan measure to block Trump tariffs with the vote count at 49-49.

NOTABLE HEADLINES

- US President Trump said the "one big beautiful bill" may be bigger than tariffs and a tax increase is unsustainable if 2017 cuts are not continued.

- US President Trump said we are going to have 'Made in the USA' like never before and he stated give us a little time to get moving regarding the economy. Furthermore, Trump said interest rates should go down and reiterated that "he (Powell) should reduce interest rates, I understand them better than him", as well as noted it would be nice for people wanting to buy homes and things.

- US President Trump told Elon Musk he is invited to stay for as long as he wants regarding working in the government, but noted that Musk wants to get back home to his cars.

- US Treasury Secretary Bessent said President Trump has created negotiating leverage and leadership, while he said the US is on the verge of becoming an AI superpower.

- There was some chatter that the House Ways and Means Committee is going to mark up their tax package on May 8th, according to Punchbowl. It was separately reported that the US House Panel dropped the proposal to remove the Federal Trade Commission's antitrust authority from the budget package.

- Wall Street firms are generally advising clients they should prepare for the Trump tariffs to bring the inflation rate up to 4% and for a slowdown in the economy by the summer, according to FBN's Gasparino.

AFTER-MARKET EARNINGS

- Microsoft Corp (MSFT) Q3 2025 (USD): Adj. EPS 3.46 (exp. 3.21), Revenue 70.1bln (exp. 68.41bln); shares rose 6.9% after-market.

- Meta Platforms Inc (META) Q1 (USD) EPS 6.43 (exp. 5.23), Revenue 42.31bln (exp. 41.43bln); shares rose 5.4% after-market.

- Qualcomm Inc (QCOM) Q2 2025 (USD): Adj. EPS 2.85 (exp. 2.80), Revenue 10.84bln (exp. 10.60bln); shares fell 5.7% after-market.

- eBay Inc (EBAY) Q1 2025 (USD): Adj. EPS 1.38 (exp. 1.34), Revenue 2.6bln (exp. 2.55bln); shares fell 1.3% after-market.

APAC TRADE

EQUITIES

- APAC stocks traded higher but with gains capped in severely thinned conditions owing to mass holiday closures across the region and in Europe for Labour Day.

- ASX 200 eked mild gains as the outperformance in tech, real estate and consumer staples was offset by losses across the commodity-related sectors, while trade data was mixed as Australian monthly exports returned to growth but imports contracted.

- Nikkei 225 advanced at the open after having reclaimed the 36,000 level and with further upside seen after the BoJ policy announcement where the central bank kept rates unchanged at 0.50% and provided some dovish rhetoric despite maintaining its rate hike signal.

- US stocks were boosted heading into the Wall St closing bell. Futures (ES +1.1%, NQ +1.5%) saw a further lift following strong earnings from Microsoft and Meta.

FX

- DXY held on to its gains after having strengthened against G10 peers into month-end and was ultimately unfazed by the soft US data releases stateside in which the GDP Advance reading came in below expectations and contracted for the first time in three years, while trade updates had little sway with USTR Greer noting it is a matter of weeks not months to have initial trade deals and US was said to have reached out to China recently for tariff talks, according to Bloomberg citing influential social media account Yuyuan Tantian which is an affiliate of Chinese state broadcaster CCTV.

- EUR/USD remained subdued firmly beneath the 1.1400 level following the prior day's declines despite stronger-than-expected EU GDP data and reports that the EU is to present trade proposals to the US next week.

- GBP/USD remained pressured following a slide from the 1.3400 territory and eventually breached 1.3300 to the downside in the absence of UK-specific catalysts.

- USD/JPY was underpinned after the BoJ policy decision in which the central bank kept rates unchanged, as expected, but cut its Real GDP and Core CPI estimates and essentially pushed back the timing for reaching the price goal.

- Antipodeans were uneventful amid the mass holiday closures and with a muted reaction seen to the somewhat mixed Australian data and import/export prices.

- BoC Minutes stated that ahead of the April 16th meeting, the Governing Council was split over whether to cut or hold as members favouring no change wanted to gain more information on US tariffs, backed a wait-and-see approach and felt another cut could be premature, given upward pressure on inflation from tariffs could come quickly. Meanwhile, members favouring a cut cited muted near-term inflation risks and signs the economy was weakening.

FIXED INCOME

- 10yr UST futures lacked firm direction following recent curve steepening in the aftermath of the disappointing US data and as participants await further key releases including Friday's NFP report.

- 10yr JGB futures surged in the aftermath of the BoJ policy decision in which the central bank kept rates unchanged, lowered its projections for Real GDP and Core CPI and pushed back the timing for when underlying consumer inflation is likely to be at a level generally consistent with the 2% target.

COMMODITIES

- Crude futures were stuck around the prior day's trough after slumping amid source reports that Saudi officials briefed allies and industry experts that the kingdom can sustain a prolonged period of low oil prices.

- Saudi officials reportedly briefed allies and industry experts that the kingdom can sustain a prolonged period of low oil prices, according to Reuters citing sources.

- Spot gold retreated following the recent pullback to beneath the USD 3,300/oz level and after the precious metal notched its fourth consecutive monthly gain in April.

- Copper futures traded sideways amid the mass holiday closures in the region including its largest buyer, China, which is shut for a five-day weekend.

CRYPTO

- Bitcoin edged higher overnight and climbed to just shy of the USD 95,000 level before fading some of the gains.

- Ripple offered to buy stablecoin rival Circle for up to USD 5bln although Circle was said to have rejected the Ripple bid as too low.

NOTABLE ASIA-PAC HEADLINES

- BoJ maintained its short-term interest rate target at 0.5%, as expected, with the decision made by unanimous vote, while it said it will continue to raise the policy rate if the economy and prices move in line with its forecast and will conduct monetary policy appropriately from the perspective of sustainably and stably achieving the 2% inflation target. BoJ said Japan's economic growth is likely to moderate and underlying consumer inflation is likely to be at a level generally consistent with the 2% target in the second half of the projection period from fiscal 2025 through 2027, as well as noted that uncertainty surrounding Japan's economy and prices remains high with risks to the economic outlook and inflation outlook are skewed to the downside. Furthermore, it lowered its evaluation of the economic outlook and warned that a prolonged period of high uncertainties regarding trade and other policies could lead firms to focus more on cost-cutting, and as a result, moves to reflect price rises in wages could also weaken. In terms of the Outlook Report projections, the Real GDP median forecast for Fiscal 2025 was cut to 0.5% from 1.1% and the Fiscal 2026 estimate was cut to 0.7% from 1.0%, while the Core CPI median forecast for Fiscal 2025 was cut to 2.2% from 2.4% and the Fiscal 2026 forecast was cut to 1.7% from 2.0%.

DATA RECAP

- Australian Balance on Goods (AUD)(Mar) 6,900M vs. Exp. 3,900M (Prev. 2,968M)

- Australian Goods/Services Exports (Mar) 7.60% (Prev. -3.60%)

- Australian Goods/Services Imports (Mar) -2.2% (Prev. 1.60%)

- Australian Export Prices (Q1) 2.1% (Prev. 3.6%)

- Australian Import Prices (Q1) 3.3% (Prev. 0.2%)

GEOPOLITICS

MIDDLE EAST

- US Secretary of Defence Hegseth said Iran will pay the consequence for supporting Houthis.

RUSSIA-UKRAINE

- US and Ukraine signed an agreement on access to natural resources and to establish a US-Ukraine reconstruction investment fund. It was also reported that the US Treasury said the Treasury Department and US International Development Finance Corporation will work with Ukraine to finalise programme governance and advance the partnership, while it added that the agreement signals clearly to Russia that the Trump administration is committed to a peace process centred on a free, sovereign, and prosperous Ukraine over the long term. Furthermore, Treasury Secretary Bessent said the US–Ukraine economic partnership agreement allows the United States to invest alongside Ukraine to "unlock Ukraine's growth assets".

- US Senator Graham, who is a close ally of President Trump, is forging ahead on a plan to impose new sanctions on Russia and steep tariffs on countries that buy Russian oil, gas and uranium, while the bill also would impose a 500% tariff on imported goods from any country that purchases Russian oil, gas, uranium and other products, according to WSJ.

- Russian President Putin said he has no doubt that Russia's relations with Europe will be restored sooner or later.

- EU High Representative for Foreign Affairs and Security Policy Kallas said the EU is readying a 'Plan B' should US President Trump walk away from Ukraine talks, according to FT.

OTHER

- US Secretary of State Rubio spoke with Indian External Affairs Minister Subrahmanyam Jaishankar and encouraged India to work with Pakistan to de-escalate tensions and maintain peace and security in South Asia.

EU/UK

NOTABLE HEADLINES

- ECB’s Makhlouf said price risks are less clear in the medium term than near-term.

- EU Commissioner Dombrovskis said 12 EU member states have requested the activation of a national escape clause to boost defence spending.