APAC stocks fail to sustain strong handover after weak Chinese PMIs, Mag7 earnings ahead - Newsquawk Europe Market Open

- US President Trump said he is going to make a fair deal with China on trade; predicts that China will eat the tariffs.

- APAC stocks failed to sustain the positive handover from Wall St and traded mixed; Chinese official PMIs disappointed.

- European equity futures indicate a contained cash market open with Euro Stoxx 50 future flat after the cash market closed with losses of 0.2% on Tuesday.

- DXY is a touch higher and building on yesterday's slight gains, EUR/USD is back on a 1.13 handle, AUD leads post-CPI.

- Looking ahead, highlights include French GDP, German Import Prices, Retail Sales, Unemployment Rate, GDP, CPI, Italian GDP, CPI, EZ GDP, US ADP, GDP, PCE (Q1 & for March), ECI, BoC Minutes, BoE’s Lombardelli, Supply from UK, Germany & US.

- Earnings from Microsoft, Meta, Robinhood, Qualcomm, Albemarle, eBay, Humana, Caterpillar, International Paper, GE Healthcare, Hess, Airbus, Credit Agricole, TotalEnergies, SocGen, UBS, DHL, Kion, Volkswagen, Mercedes Benz, Barclays, GSK, Segro & Glencore.

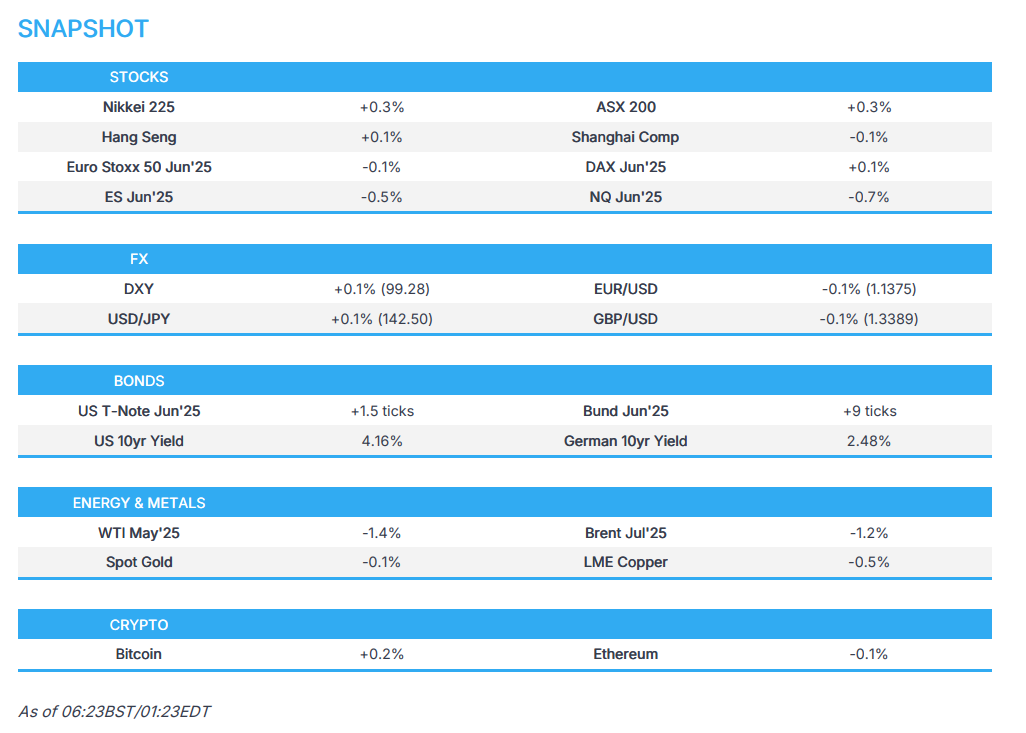

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks edged higher for large parts of the US session and the major indices extended on their recent gains with both the S&P 500 and Dow notching a sixth consecutive win streak as tariffs remained in the spotlight with US President Trump to ease tariffs for US automakers at a speech in Michigan commemorating his first 100 days in office. There were also comments from other officials including US Commerce Secretary Lutnick who suggested a trade deal was reached with a country which he didn't name until approval from the other side, although FBN's Gasparino later suggested, citing word on Wall St, it could either be India or South Korea. Nonetheless, the gains in stocks were mild with upside limited as participants also digested data releases in which JOLTS printed below the bottom end of analyst estimates, while consumer confidence also disappointed and tumbled beneath expectations with responses detailing tariff concerns.

- SPX +0.58% at 5,561, NDX +0.61% at 19,545, DJI +0.75% at 40,528, RUT +0.56% at 1,977.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump signed a Proclamation on "AMENDMENTS TO ADJUSTING IMPORTS OF AUTOMOBILES AND AUTOMOBILE PARTS INTO THE UNITED STATES" and an Executive Order on "ADDRESSING CERTAIN TARIFFS ON IMPORTED ARTICLES", which followed earlier reports that Trump is to sign three orders on auto manufacturing, according to Bloomberg citing an official.

- US President Trump says they are coming from all over the world, including China, looking to make a deal and he confirmed to ease the impact of auto tariffs, while Trump added they are going to make a fair deal with China on trade, as well as commented that China deserves the tariffs and predicts that China will eat the tariffs.

- US President Trump congratulated Canadian PM Carney on the election win and said the leaders agreed to meet in person in the near future, while Carney said they agreed on the importance of Canada and the US working together, as independent, sovereign nations, for their mutual benefit.

- US President Trump said India is coming along great and thinks they have a deal on tariffs, while he is not at all worried about the auto industry and will be talking to the PM of Australia about trade.

- US Treasury Secretary Bessent said there was a plan for changes to auto tariffs and that factories in China are having to shut down, while he added they have seen substantial estimates of layoffs in China, according to an interview with FBN.

- US Commerce Secretary Lutnick said adjustments to autos tariffs are aimed at allowing domestic automakers time to grow US plants and employment, while the Executive Order grew out of a positive detailed conversation with domestic car makers. Lutnick said manufacturers of US-built autos will get a 15% offset for the value of those vehicles against parts imports and all cars that are finished in the US that have 85% domestic content will have no tariffs. Furthermore, he said auto manufacturers will pick the highest tariff that comes with their goods and they will only pay one whereby they will either pay the steel or auto tariff, whichever is higher.

- US Commerce Secretary Lutnick said a 10% tariff is 'virtually' not going to change prices, while he noted one trade deal has been reached with a country he did not name and is waiting for approval from the other country before announcing.

- US Trade Representative Greer told GOP senators that countries are coming to the table on tariff talks but noted Europe is not engaging as well, according to PBS News.

- White House Economic Adviser Miran said we will hopefully start hearing about deals that are done in the coming days to weeks and expects they will move towards a form of de-escalation which will come sometime in the near future, while he added other countries will bear the burden "in the fullness of time.

- US official said 25% will stack on top of the Most-Favoured-Nation rate and offset amount will be applied at the April 3rd start date of tariffs, based on production thereafter, according to Reuters.

- US President Trump reportedly called Amazon (AMZN) founder Jeff Bezos on Tuesday to complain about reports Amazon was considering displaying the cost of US tariffs next to prices for certain products on its website, while an Amazon spokesman released a statement clarifying the move wasn't considered for the main Amazon site but was considered for Amazon Haul and later sent CNN a revised statement that "This was never approved and not going to happen", according to CNN's Alayna Treene.

- South Korean industry officials are to visit Washington on Wednesday for tariff discussions with US counterparts, while South Korean Finance Minister Choi said they not rushing to negotiate on tariffs with the US and they are "absolutely not" trying to conclude tariff talks with the US before the presidential election.

- US officials have split trade negotiations into three phases, the UK has reportedly been placed in either phase two or three, via the Guardian citing sources. UK officials are also concerned that any EU-UK deal could make negotiations with the US more challenging..

NOTABLE HEADLINES

- US President Trump said he achieved the 100 most successful days for a president in US history, while he noted a lot of auto jobs and companies are coming in and we're restoring the rule of law and ending the inflation nightmare, as well as stated the person at the Fed is not doing a good job.

- US President Trump is to hold a cabinet meeting on Wednesday at 11:00EDT/16:00BST.

- US Senate is to vote on the President Trump tariff resolution on Wednesday although Trump has said he would veto the measure if it passes Congress.

- Top Trump advisor reportedly struggled to soothe investors in talks after market tumult in which Stephen Miran met with hedge funds and big asset managers after tariffs sparked Wall Street turmoil, according to FT.

- Atlanta Fed GDPNow (Q1 25): -2.7% (prev. -2.4% on 24th April); Gold adjusted -1.5% (prev. -0.4%).

APAC TRADE

EQUITIES

- APAC stocks failed to sustain the positive handover from Wall St and traded mixed at month-end as the region digested a slew of data including disappointing Chinese official PMIs, while there was a muted reaction and very few surprises from US President Trump's speech to commemorate his first 100 days back in office.

- ASX 200 eked mild gains as strength in tech, healthcare and financials offset the losses in the utilities and commodity-related sectors but with the upside limited after firmer-than-expected CPI data saw money markets fully price out the chances of a larger 50bps RBA rate cut in May.

- Nikkei 225 was choppy with the upside contained following disappointing Industrial Production and Retail Sales, while the BoJ also kick-started its two-day policy meeting and there were some comments from a group representing major foreign automakers which noted that President Trump's latest tariff order for autos provides some relief but more must be done.

- Hang Seng and Shanghai Comp were indecisive after official Chinese Manufacturing and Non-Manufacturing PMIs disappointed although Caixin Manufacturing PMI topped forecasts, while the mainland heads into a five-day weekend owing to Labor Day holiday closures and participants also reflected on key earnings releases including disappointing results from China's Big 4 banks.

- US equity futures (ES -0.4%, NQ -0.6%) pulled back as participants braced for a slew of key data releases and upcoming mega-cap earnings.

- European equity futures indicate a contained cash market open with Euro Stoxx 50 future flat after the cash market closed with losses of 0.2% on Tuesday.

FX

- DXY eked mild gains after the prior day's rebound despite the recent disappointing data releases in which US Consumer Confidence deteriorated for a fifth consecutive month and job openings fell to a six-month low. Nonetheless, tariffs remained in focus as President Trump signed an order to prevent the stacking of tariffs for automakers and reiterated they are going to get a fair deal with China, while participants now look ahead to a slew of data releases including US ADP, GDP and PCE data.

- EUR/USD marginally weakened after failing to sustain the 1.1400 status with the single currency not helped by the deterioration of EZ sentiment in April, while there is also a busy calendar ahead for the bloc including the latest GDP figures for the EU and key member states such as Germany, France and Italy.

- GBP/USD slightly softened in rangebound trade after the recent choppy mood and oscillations around the 1.3400 level.

- USD/JPY lacked conviction after Industrial Production and Retail Sales disappointed and with participants awaiting a potentially hawkish hold from the BoJ when it concludes its 2-day policy meeting on Thursday.

- Antipodeans eked mild gains with AUD/USD supported by firmer-than-expected CPI data but with gains capped as Chinese official PMIs disappointed.

- PBoC set USD/CNY mid-point at 7.2014 vs exp. 7.2670 (Prev. 7.2029).

FIXED INCOME

- 10yr UST futures took a breather after rallying across the curve yesterday as weak data stoked growth concerns, while supply and key data loom.

- Bund futures kept afloat but with the upside capped ahead of a slew of German data including GDP, CPI, Unemployment Rate and Retail Sales figures.

- 10yr JGB futures price action was choppy on return from the holiday closure and with a lack of conviction as the BoJ kick-started its 2-day policy meeting.

COMMODITIES

- Crude futures remained pressured after retreating throughout the prior day with demand subdued by trade uncertainty and weak data, while the latest private sector inventory data showed a larger-than-expected build for headline crude stockpiles.

- US Private inventory data (bbls): Crude +3.8mln (exp. +0.5mln), Distillate -2.5mln (exp. -1.7mln), Gasoline -3.1mln (exp. -1.2mln), Cushing +0.7mln.

- Spot gold trickled lower following the prior day's indecisive performance and with prices constrained by a mildly firmer buck.

- Copper futures declined amid headwinds from the mixed risk appetite and disappointing Chinese official PMI data.

- Chile's Codelco Chairman said April Copper production +22% Y/Y.

CRYPTO

- Bitcoin gradually climbed throughout the session and returned to above the USD 95,000 level.

NOTABLE ASIA-PAC HEADLINES

- China NPC standing committee passed the private sector promotion law which will take effect from May 20th.

- Australian Treasurer Chalmers said the market expects more interest rate cuts after inflation figures and he doesn't see anything in the data as substantially altering market expectations.

DATA RECAP

- Chinese NBS Manufacturing PMI (Apr) 49.0 vs. Exp. 49.8 (Prev. 50.5)

- Chinese NBS Non-Manufacturing PMI (Apr) 50.4 vs. Exp. 50.6 (Prev. 50.8)

- Chinese Composite PMI (Apr) 50.2 (Prev. 51.4)

- Chinese Caixin Manufacturing PMI Final (Apr) 50.4 vs. Exp. 49.8 (Prev. 51.2)

- Japanese Industrial Production MM SA (Mar P) -1.1% vs. Exp. -0.4% (Prev. 2.3%)

- Japanese Retail Sales YY (Mar) 3.1% vs. Exp. 3.5% (Prev. 1.4%, Rev. 1.3%)

- Australian CPI QQ (Q1) 0.9% vs. Exp. 0.8% (Prev. 0.2%)

- Australian CPI YY (Q1) 2.4% vs. Exp. 2.3% (Prev. 2.4%)

- Australian RBA Trimmed Mean CPI QQ (Q1) 0.7% vs. Exp. 0.6% (Prev. 0.5%)

- Australian RBA Trimmed Mean CPI YY (Q1) 2.9% vs. Exp. 2.8% (Prev. 3.2%)

- Australian Weighted CPI YY (Mar) 2.40% vs. Exp. 2.20% (Prev. 2.40%)

- Australian CPI Annual Trimmed Mean YY (Mar) 2.70% (Prev. 2.70%)

- New Zealand ANZ Business Outlook (Apr) 49.3% (Prev. 57.5%)

- New Zealand ANZ Own Activity (Apr) 47.7% (Prev. 48.6%)

GEOPOLITICS

MIDDLE EAST

- US Treasury targets networks in Iran and China for their role in procuring missile propellant ingredients for Iran.

- UK forces participated in a joint operation with US forces against a Houthi military target in Yemen, while the UK said the strike was conducted after dark when the likelihood of any civilians being in the area was reduced and all aircraft returned safely.

RUSSIA-UKRAINE

- US President Trump said he thinks Russian President Putin wants peace but he was not happy when he saw Putin shooting missiles, according to ABC News.

- US Secretary of State Rubio said they are now at a time where concrete proposals need to be submitted by Russia and Ukraine, while he added that if there is no progress, the US will step back as mediators in this process.

- White House Press Secretary said President Trump is confident the Ukraine minerals deal will be signed.

OTHER NEWS

- Pakistan's Information Minister said they have credible evidence that India is planning "military aggression" against Pakistan within 24-36 hours.

- North Korea conducted the first test firing of a new warship, according to Yonhap. It was also reported that South Korean intelligence assessed that North Korea's combat capabilities have improved and that North Korea suffered 600 deaths during its dispatch of troops to Russia, while South Korean intelligence is monitoring a possible surprise summit between North Korea and the US.

EU/UK

DATA RECAP

- UK Lloyds Business Barometer (Apr) 39 (Prev. 49)