WTI 'Off The Lows' After Large Crude/Gasoline Inventory Draws; Pump-Prices Set To Tumble

Oil prices extended their recent plunge this morning as traders expect Saudi Arabia to steer OPEC+ to agree on another supply surge next week as the kingdom continues its campaign to discipline the cartel’s errant members.

“History shows that when OPEC+ leadership decides to encourage compliance by supply pressure, it does not stop until it achieves its goal,” said Bob McNally, president and founder of Rapidan Energy Advisers LLC and a former White House energy official.

Overnight we saw a mixed bag from API (big crude build and bid product draws). Now let's see what the official data has to show...

API

Crude +3.8mm

Cushing +674k

Gasoline -3.1mm

Distillates -2.5mm

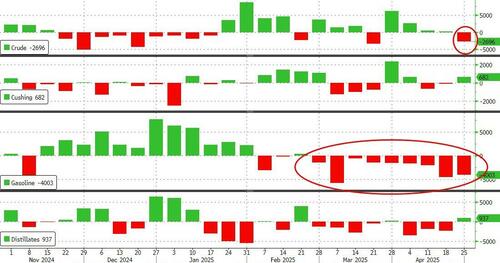

DOE

Crude -2.696mm

Cushing +682k

Gasoline -4.003mm

Distillates +937k

The official data was just as mixed but showed a sizable draw in crude inventories and gasoline stocks (fell for the ninth week in a row)...

Source: Bloomberg

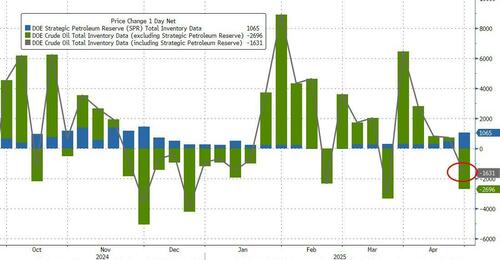

Even including a large 1.065mm barrel addition to the SPR, total US Crude stocks fell last week...

Source: Bloomberg

US crude production remains near record highs but 'drill baby drill' is not so obvious in the rig count data...

Source: Bloomberg

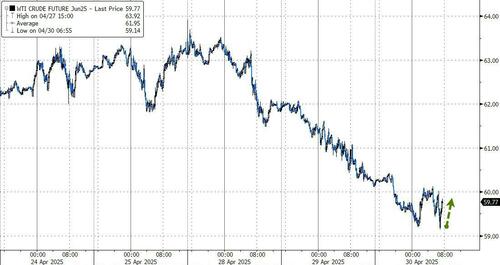

WTI is 'off the lows' after the official data...

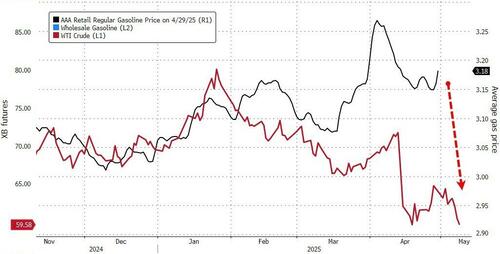

Finally, while the price rout does offer relief for consumers and central banks still feeling the effects of inflation, it spells financial pain for oil producers.

Texas oilman Bryan Sheffield has urged companies to scale back drilling to avert an industry “blood bath,” while consultant Rystad Energy slashed its estimates for US onshore crude growth by more than half. The Saudis themselves aren’t immune, requiring an oil price near $90 a barrel to cover government spending, according to the International Monetary Fund.

“Increasing supply to maximize revenue might be the optimal strategy” for producers, said Natasha Kaneva, head of global commodities research at JPMorgan Chase & Co.